Back to Home

Introduction to Aalps Protocol

Introduction to Aalps Protocol

2024. 8. 1.

💡 Aalps Protocol is building the 21st Century’s Mercantile Exchange.

The commodity industry’s centuries’ old designs have fundamental flaws in its incentive structures and market efficiency — Aalps is redefining market efficiency by leveraging innovative cryptographic & blockchain primitives.

1. Intro

Aalps Protocol is a decentralized mercantile exchange that reduces information asymmetry by redistributing exchange revenue to incentivize a global intelligence network:

Aalps Alpha: A fully on-chain market for intelligence, where agents will be incentivized by redistributed exchange revenues from Aalps Finance, making participants of the global intelligence network both stakeholders and beneficiaries.

More details here: [Aalps Protocol 02] Introducing Aalps Alpha - Where Alphas Flow On-Chain For Better Predictions

Aalps Finance: A global, 24/7 permissionless futures trading platform that offers cash-settled contracts

At Aalps Labs, we are pioneering novel, fundamental incentive designs that would improve the underlying dynamics of commodities market

2. Flaws of “Spontaneous Orders” in the Old-World Commodity Market

While the concept of spontaneous orders—the natural emergence of order from individual actions without central planning—has been lauded for its efficiency in various domains, it reveals significant flaws when applied to the commodities market.

First, although the commodities market is structurally decentralized, it lacks a global coordination layer for both value and information. This absence leads to inefficiencies and missed opportunities for optimal resource allocation. Imagine a symphony where each musician plays their part flawlessly, only to lose harmony without a conductor. Similarly, the commodities market struggles without a standardized coordinating mechanism. (More on this on [Aalps Commodities 01] Why Commodities in 2024?)

Secondly, trading operates on exchanges in a permissioned manner, where only selected participants can engage fully. This restricted access not only stifles competition but also perpetuates the dominance of established players, akin to an exclusive club where only a few hold the keys to the gate. This exclusivity undermines the principles of free market competition and innovation.

Lastly, deep information asymmetry plagues the market. In a perfect world, all participants would have equal access to information, enabling fair competition. However, the reality is more like a poker game where some players have seen the cards in advance. This imbalance leads to unfair advantages and market distortions, making the spontaneous order more chaotic than organized. Addressing these flaws is crucial for creating a more equitable and efficient commodities market.

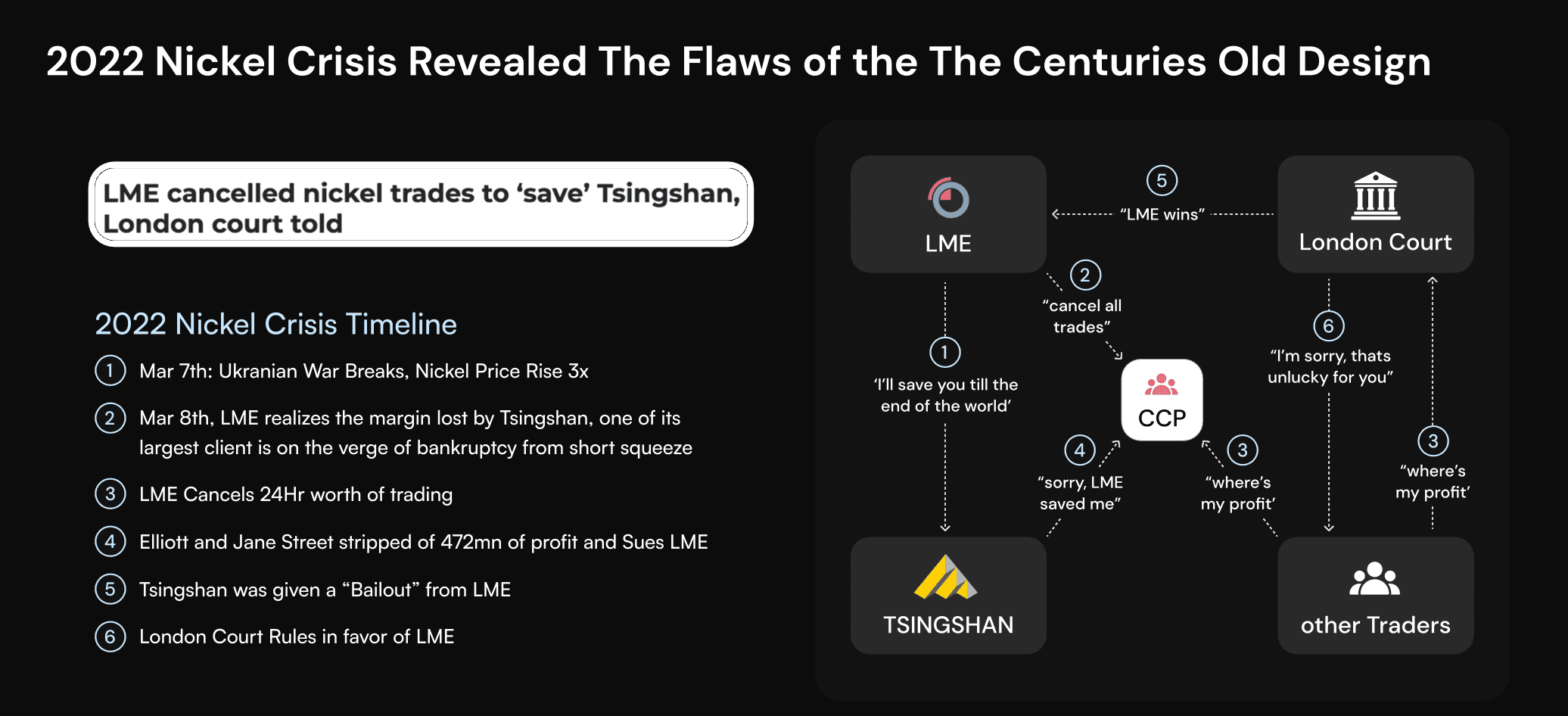

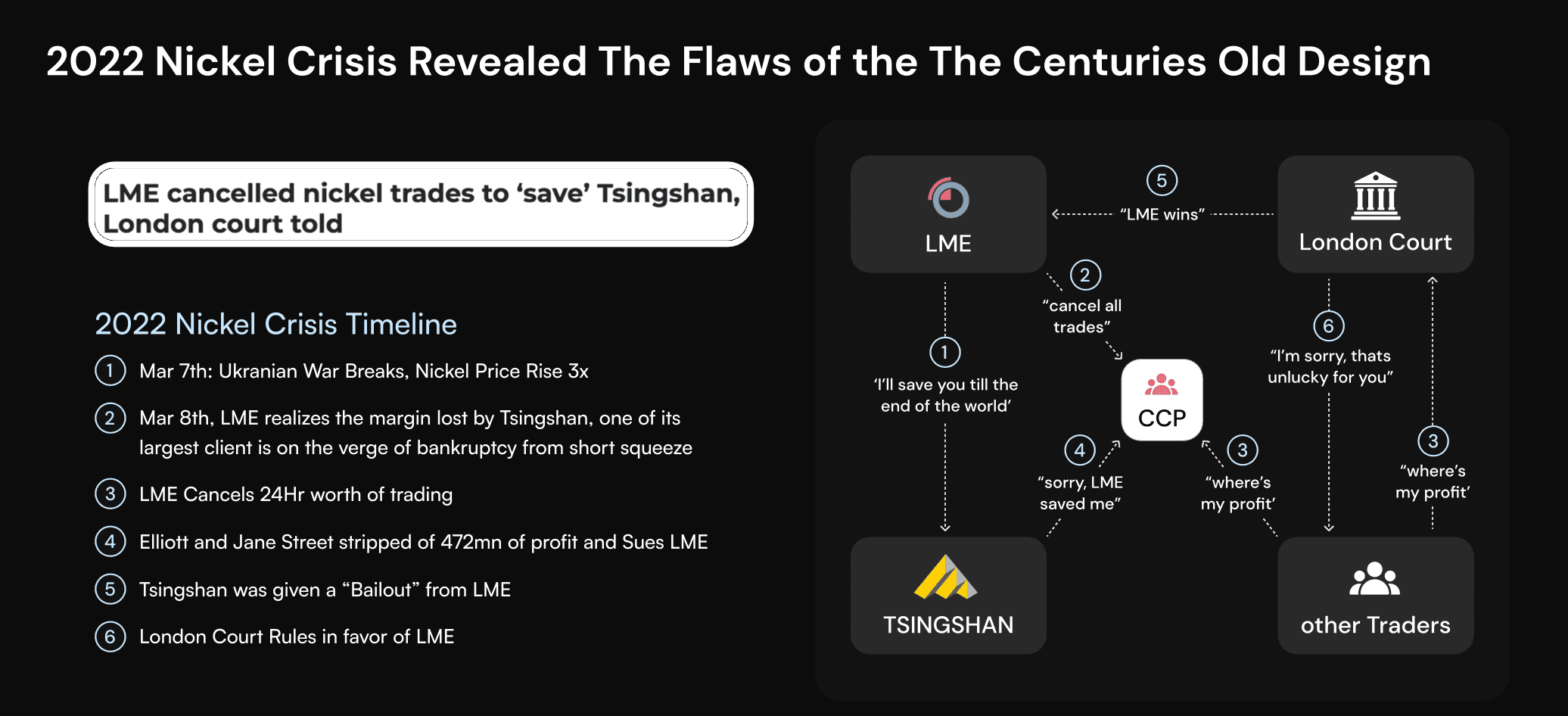

The 2022 nickel crisis on the London Metal Exchange (LME) is a fitting example where both flaws were exposed. The crisis, triggered by a massive short squeeze centered on Tsingshan Holding Group Co., highlighted the market's lack of a global coordination layer, restricted access, and deep information asymmetry. The LME's failure to understand and police large positions, particularly in the over-the-counter (OTC) market, contributed to the chaos. The exchange's decision to cancel trades and suspend the market was criticized for its impact on investors and the broader market. Regulatory probes and court rulings have since scrutinized the LME's actions, with the court ruling in favor of the LME's decisions. The crisis has led to calls for reforms, including tougher oversight of the OTC market, harsher position limits, and enhanced risk management controls.

For more details, refer to our previous blog post: [Aalps Commodities 02] Spontaneous Order of Commodity Markets — 2022 Nickel Crisis

3. What 21st Century Mercantile Exchange Needs

💡 Internet opened up free flow of information. Crypto enabled frictionless transfer of value.

Why have we still not achieved anything near strong market efficiency through incentivizing information exchanges (positive market externalities)?

The 21st century has ushered in an era of unprecedented technological advancements, yet the commodities market remains stubbornly inefficient. Despite the internet enabling the free flow of information and cryptocurrencies facilitating frictionless value transfer, most web-enabled markets still grapple with significant inefficiencies arising from information asymmetry. So, why hasn't the promise of a truly efficient market materialized?

The answer lies in the structural and systemic issues that plague our current market frameworks. Traditional markets are often bogged down by permissioned systems that restrict access, creating barriers to entry and perpetuating the dominance of established players through reinforcing the informational superiority that they have. This exclusivity stifles competition and innovation. Moreover, the sheer absence of a global coordination layer for both value and information exacerbates these inefficiencies, leading to suboptimal resource allocation and missed opportunities.

Enter 21st Century and the cryptographic primitives available. (More on our team’s perspectives here: [Aalps Protocol 01] DeFi — The “Nuclear Bomb Invention” of Modern Financial System ) These technologies offer a glimpse into a future where financial infrastructure is permissionless and global, breaking down the barriers that have long hindered market efficiency. By leveraging better incentive designs, DeFi can significantly reduce market externalities and create a more equitable playing field. Imagine a world where the hierarchy of money and liquidity are not dictated by centralized entities but are instead governed by transparent, decentralized protocols. This is not just a utopian dream, but a tangible reality that DeFi is steadily building towards[4][5].

Prediction markets are a prime example of how decentralized technologies can revolutionize traditional financial systems. These markets allow users to bet on the outcomes of future events, thereby aggregating diverse pieces of information into a single, actionable metric. However, for prediction markets to truly represent efficient markets, the flow of information must be transparent and uncloaked. In the current Web2 paradigm, information is often value-attached through advertisements, which centralize control and limit the free exchange of information[1][6]. (This was what Web3 originally sought to combat.)

Perpetual futures, another innovation in the DeFi space, offer a global liquidity layer for permissionless, efficient markets. Unlike traditional futures contracts, perpetual futures have no expiration date, allowing traders to speculate on asset prices indefinitely. This feature, coupled with a funding rate mechanism that keeps prices aligned with the underlying market, makes perpetual futures a powerful tool for accommodating incoming hedging/speculative demands [7][9] globally and permissionlessly.

In conclusion, the 21st-century mercantile exchange needs to embrace the transformative potential of decentralized technologies. By creating a permissionless, global financial infrastructure and leveraging better incentive designs, we can address the inefficiencies that plague traditional markets. The future of market efficiency lies in the seamless integration of information and value transfer, a vision that DeFi is uniquely positioned to realize.

You can read more about our team’s perspectives on DeFi here: [Aalps Protocol 01] DeFi — The “Nuclear Bomb Invention” of Modern Financial System

FAQ

1. Why commodities markets?

It’s a long story, but you’ll find our thesis interesting. Please refer to [Aalps Commodities 01] Why Commodities in 2024?

💡 “I would pay thousands of dollars to get advance notice from my contact at the Panamanian port authority about an impending strike that could disrupt fertilizer shipments from Columbia.” — A Fertilizer Trader we interviewed

2. How are information providers incentivized?

Information sellers can engage in various activities for monetizing the information they have. (e.g. auction activity, open up subscription channels). Moreover, Aalps’ tokenomics and value accrual will be directed towards information providers who are the core network members.

3. What kind of information can you buy? What kind of products can you sell?

More elaboration of our approach here. Some examples would be

Soybean planting 80% complete in Mato Grosso. Soil moisture levels optimal after recent rains. Expect above average yields if weather holds. #soybeans #Brazil #agriculture

Pioneer Natural Resources idling 5 rigs in the Permian Basin due to low oil prices. Expect 50,000 bpd production cut. #shale #oilandgas #Permian

4. What are perpetual futures?

One liner: it’s a single stock etf, but with short position held by someone on the other side. Please refer to [Aalps Research 01] What Is Perpetual Futures? (ELI5 with Intro Resources)

More advanced materials at [Aalps Research 02] Perpetuals Research Insights

About Aalps Labs

We are a team committed to redefining the core dynamics of the commodities market by optimizing the free flow of information and value. We have deep expertise in commodities, engineering and cryptography. If you want to talk with us, feel free to reach out to us at contact@aalps.me

More about us: https://www.aalps.me

💡 Aalps Protocol is building the 21st Century’s Mercantile Exchange.

The commodity industry’s centuries’ old designs have fundamental flaws in its incentive structures and market efficiency — Aalps is redefining market efficiency by leveraging innovative cryptographic & blockchain primitives.

1. Intro

Aalps Protocol is a decentralized mercantile exchange that reduces information asymmetry by redistributing exchange revenue to incentivize a global intelligence network:

Aalps Alpha: A fully on-chain market for intelligence, where agents will be incentivized by redistributed exchange revenues from Aalps Finance, making participants of the global intelligence network both stakeholders and beneficiaries.

More details here: [Aalps Protocol 02] Introducing Aalps Alpha - Where Alphas Flow On-Chain For Better Predictions

Aalps Finance: A global, 24/7 permissionless futures trading platform that offers cash-settled contracts

At Aalps Labs, we are pioneering novel, fundamental incentive designs that would improve the underlying dynamics of commodities market

2. Flaws of “Spontaneous Orders” in the Old-World Commodity Market

While the concept of spontaneous orders—the natural emergence of order from individual actions without central planning—has been lauded for its efficiency in various domains, it reveals significant flaws when applied to the commodities market.

First, although the commodities market is structurally decentralized, it lacks a global coordination layer for both value and information. This absence leads to inefficiencies and missed opportunities for optimal resource allocation. Imagine a symphony where each musician plays their part flawlessly, only to lose harmony without a conductor. Similarly, the commodities market struggles without a standardized coordinating mechanism. (More on this on [Aalps Commodities 01] Why Commodities in 2024?)

Secondly, trading operates on exchanges in a permissioned manner, where only selected participants can engage fully. This restricted access not only stifles competition but also perpetuates the dominance of established players, akin to an exclusive club where only a few hold the keys to the gate. This exclusivity undermines the principles of free market competition and innovation.

Lastly, deep information asymmetry plagues the market. In a perfect world, all participants would have equal access to information, enabling fair competition. However, the reality is more like a poker game where some players have seen the cards in advance. This imbalance leads to unfair advantages and market distortions, making the spontaneous order more chaotic than organized. Addressing these flaws is crucial for creating a more equitable and efficient commodities market.

The 2022 nickel crisis on the London Metal Exchange (LME) is a fitting example where both flaws were exposed. The crisis, triggered by a massive short squeeze centered on Tsingshan Holding Group Co., highlighted the market's lack of a global coordination layer, restricted access, and deep information asymmetry. The LME's failure to understand and police large positions, particularly in the over-the-counter (OTC) market, contributed to the chaos. The exchange's decision to cancel trades and suspend the market was criticized for its impact on investors and the broader market. Regulatory probes and court rulings have since scrutinized the LME's actions, with the court ruling in favor of the LME's decisions. The crisis has led to calls for reforms, including tougher oversight of the OTC market, harsher position limits, and enhanced risk management controls.

For more details, refer to our previous blog post: [Aalps Commodities 02] Spontaneous Order of Commodity Markets — 2022 Nickel Crisis

3. What 21st Century Mercantile Exchange Needs

💡 Internet opened up free flow of information. Crypto enabled frictionless transfer of value.

Why have we still not achieved anything near strong market efficiency through incentivizing information exchanges (positive market externalities)?

The 21st century has ushered in an era of unprecedented technological advancements, yet the commodities market remains stubbornly inefficient. Despite the internet enabling the free flow of information and cryptocurrencies facilitating frictionless value transfer, most web-enabled markets still grapple with significant inefficiencies arising from information asymmetry. So, why hasn't the promise of a truly efficient market materialized?

The answer lies in the structural and systemic issues that plague our current market frameworks. Traditional markets are often bogged down by permissioned systems that restrict access, creating barriers to entry and perpetuating the dominance of established players through reinforcing the informational superiority that they have. This exclusivity stifles competition and innovation. Moreover, the sheer absence of a global coordination layer for both value and information exacerbates these inefficiencies, leading to suboptimal resource allocation and missed opportunities.

Enter 21st Century and the cryptographic primitives available. (More on our team’s perspectives here: [Aalps Protocol 01] DeFi — The “Nuclear Bomb Invention” of Modern Financial System ) These technologies offer a glimpse into a future where financial infrastructure is permissionless and global, breaking down the barriers that have long hindered market efficiency. By leveraging better incentive designs, DeFi can significantly reduce market externalities and create a more equitable playing field. Imagine a world where the hierarchy of money and liquidity are not dictated by centralized entities but are instead governed by transparent, decentralized protocols. This is not just a utopian dream, but a tangible reality that DeFi is steadily building towards[4][5].

Prediction markets are a prime example of how decentralized technologies can revolutionize traditional financial systems. These markets allow users to bet on the outcomes of future events, thereby aggregating diverse pieces of information into a single, actionable metric. However, for prediction markets to truly represent efficient markets, the flow of information must be transparent and uncloaked. In the current Web2 paradigm, information is often value-attached through advertisements, which centralize control and limit the free exchange of information[1][6]. (This was what Web3 originally sought to combat.)

Perpetual futures, another innovation in the DeFi space, offer a global liquidity layer for permissionless, efficient markets. Unlike traditional futures contracts, perpetual futures have no expiration date, allowing traders to speculate on asset prices indefinitely. This feature, coupled with a funding rate mechanism that keeps prices aligned with the underlying market, makes perpetual futures a powerful tool for accommodating incoming hedging/speculative demands [7][9] globally and permissionlessly.

In conclusion, the 21st-century mercantile exchange needs to embrace the transformative potential of decentralized technologies. By creating a permissionless, global financial infrastructure and leveraging better incentive designs, we can address the inefficiencies that plague traditional markets. The future of market efficiency lies in the seamless integration of information and value transfer, a vision that DeFi is uniquely positioned to realize.

You can read more about our team’s perspectives on DeFi here: [Aalps Protocol 01] DeFi — The “Nuclear Bomb Invention” of Modern Financial System

FAQ

1. Why commodities markets?

It’s a long story, but you’ll find our thesis interesting. Please refer to [Aalps Commodities 01] Why Commodities in 2024?

💡 “I would pay thousands of dollars to get advance notice from my contact at the Panamanian port authority about an impending strike that could disrupt fertilizer shipments from Columbia.” — A Fertilizer Trader we interviewed

2. How are information providers incentivized?

Information sellers can engage in various activities for monetizing the information they have. (e.g. auction activity, open up subscription channels). Moreover, Aalps’ tokenomics and value accrual will be directed towards information providers who are the core network members.

3. What kind of information can you buy? What kind of products can you sell?

More elaboration of our approach here. Some examples would be

Soybean planting 80% complete in Mato Grosso. Soil moisture levels optimal after recent rains. Expect above average yields if weather holds. #soybeans #Brazil #agriculture

Pioneer Natural Resources idling 5 rigs in the Permian Basin due to low oil prices. Expect 50,000 bpd production cut. #shale #oilandgas #Permian

4. What are perpetual futures?

One liner: it’s a single stock etf, but with short position held by someone on the other side. Please refer to [Aalps Research 01] What Is Perpetual Futures? (ELI5 with Intro Resources)

More advanced materials at [Aalps Research 02] Perpetuals Research Insights

About Aalps Labs

We are a team committed to redefining the core dynamics of the commodities market by optimizing the free flow of information and value. We have deep expertise in commodities, engineering and cryptography. If you want to talk with us, feel free to reach out to us at contact@aalps.me

More about us: https://www.aalps.me