Back to Home

Introducing Aalps Alpha - Where Alphas Flow On-Chain For Better Predictions

Introducing Aalps Alpha - Where Alphas Flow On-Chain For Better Predictions

2024. 7. 17.

Unlocking the Power of Real-Time Information in Global Markets

The internet revolutionized the free flow of information. Crypto enabled the frictionless transfer of value. Yet despite these transformative technologies, a key piece has been missing: an efficient, scalable marketplace for exchanging information in return for any form of value.

What is Aalps Alpha?

Aalps Alpha is a global information marketplace where participants trade commodities-related information confidentially and anonymously in exchange for on-chain values.

Using crypto as a coordination layer, Aalps constructs a decentralized network where information sellers can directly connect with buyers and monetize their private insights for the first time.

With this global primitive in place, Aalps Protocol reimagines market efficiency at a whole new level. We believe Aalps Alpha will be the critical first step towards redefining the underlying dynamics of the commodities markets in the long term. More on this in our Aalps Manifesto and [WIP v1.2] Aalps Protocol Introduction

What is the problem?

Demand for quality information is extremely high among commodities traders and general industries. But as there is no global marketplace, information is under-supplied. Ones that are supplied circulate only in extremely private circles.

Imagine a Chilean copper mine worker who learns of an ongoing strike, an oil executive who learns of a major new discovery, or a farmer who detects ideal weather conditions for a bumper crop.

These are all invaluable information that could potentially be worth thousands of dollars, if they find the “right” end consumer — whether it be a copper trader in Chicago, oil refinery executive in Korea or a fertilizer manufacturer located in India — along the supply chain. For global professionals, these information are simply invaluable.

Apparently, 90% of them fail to reach to the right person for the time being, because there is no global marketplace where you can buy and sell these information. This led to two consequences. First, while quality information always does exist somewhere, it is not supplied to those in serious need of it. Second, seldom when information is supplied, because there is no marketplace at scale, it circulates only in extremely private circles (e.g. private Whatsapp group chats).

What must be considered when building a solution?

The key to a any successful marketplace is pricing mechanisms that are compatible with various participants’ incentives, scalable matching system, and efficient signaling tools. This also applies to information marketplace for commodities, too.

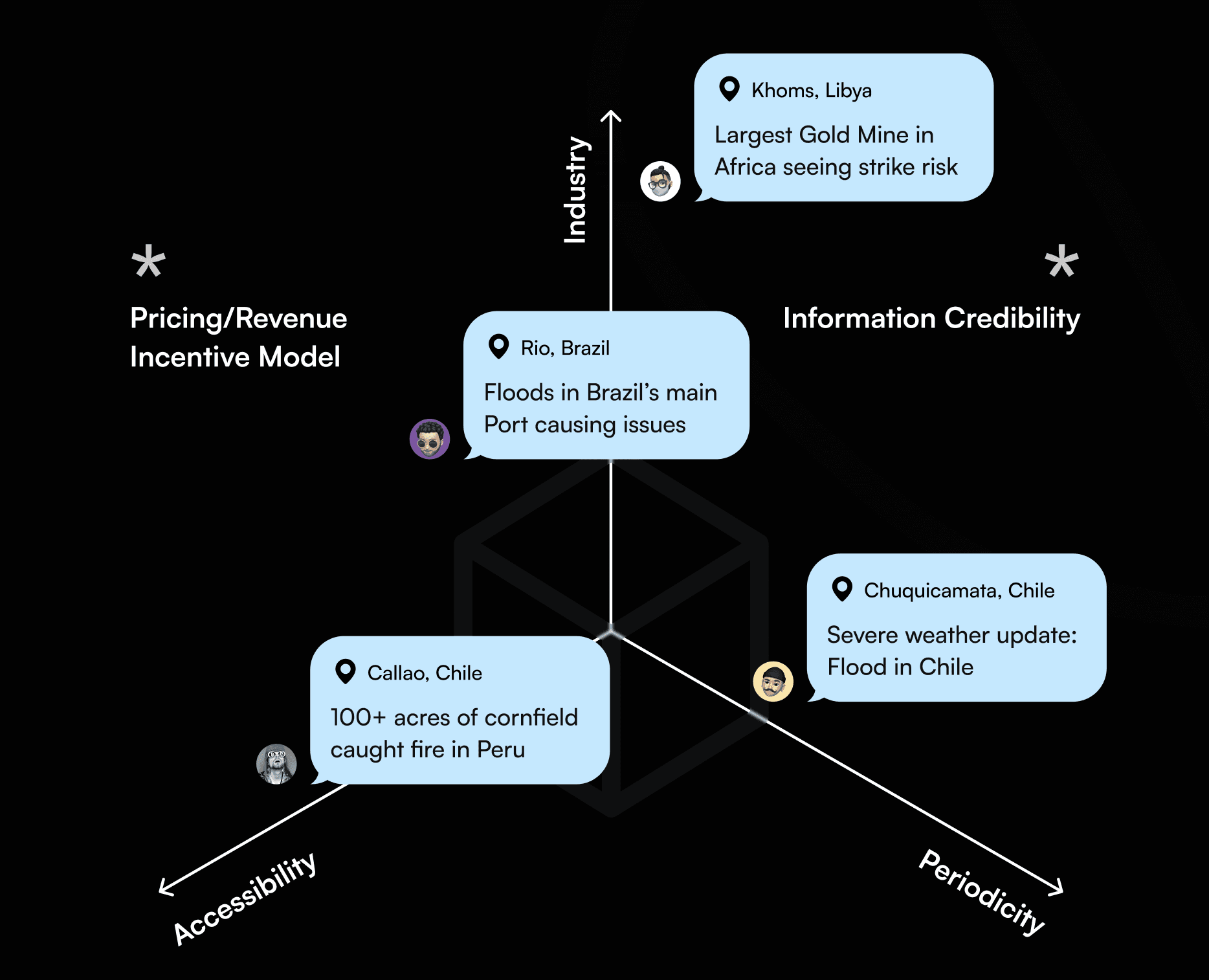

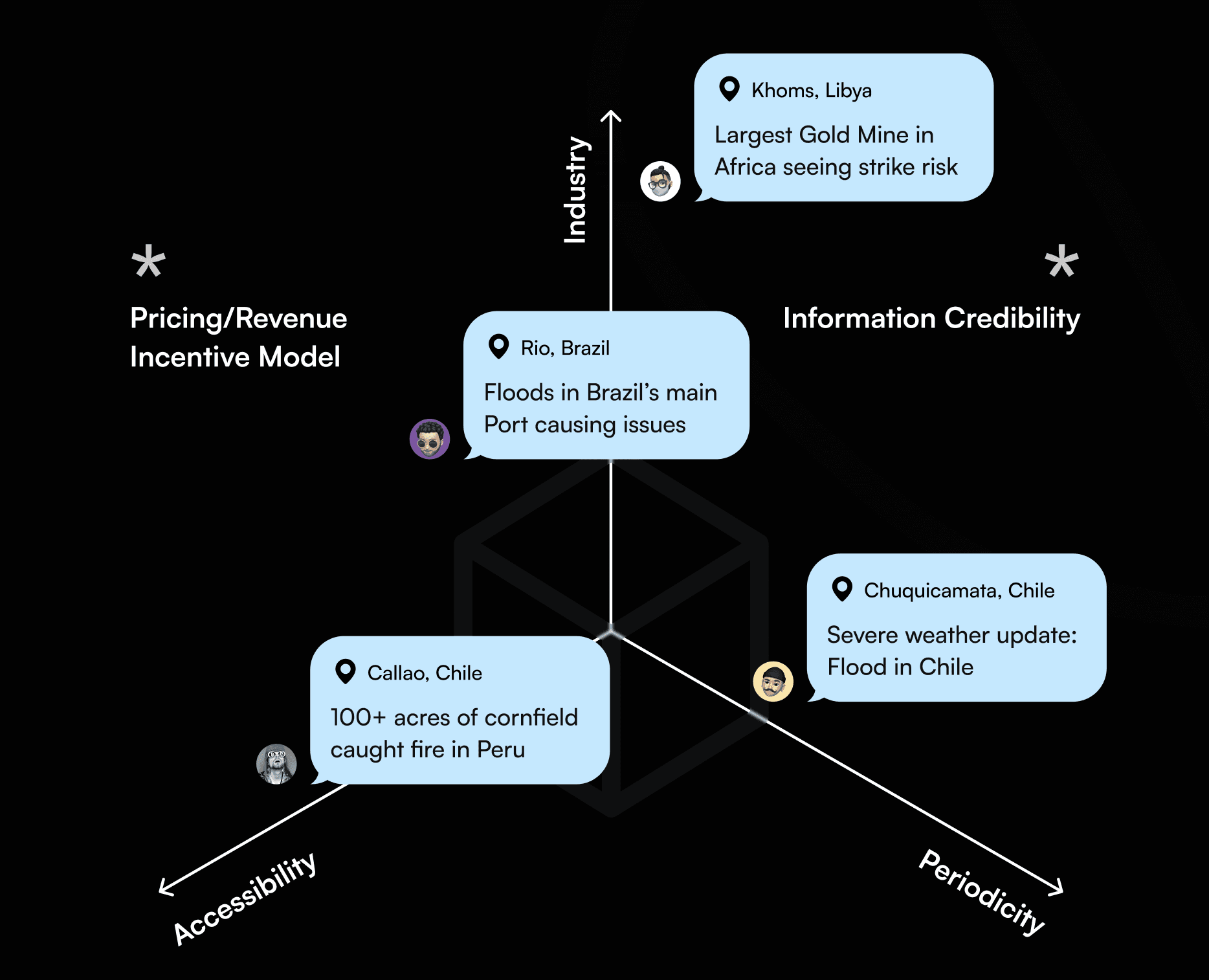

First, we need to clearly identify what types of information is of interest. We identify three main axis that constitute our mental model map of the information space.

The first axis is along the spectrum of different industries within the commodities industry. This could range from shipping, mining, energy, smelter, refining, manufacturing, packaging, etc.

The second axis is along the spectrum of accessibility of the information. Are these information that can only be attained if you are within a specific organization? Above certain level? Is this something you can still find out as a partnering firm? Is this something anyone physically present in the region also has access to?

The third axis is around periodicity of the information. Is this information valuable if delivered on a periodic manner? (e.g. Indian farm’s crop yield or expected production level of a mining firm) Is this more of an one-off event news? (e.g. an explosion in an Iranian town or a new discovery of a potential mining site) Is this piece of information something that someone would be interested in monitoring and keep an eye on over time?

Moreover, we also add two additional north stars that we constantly return to. These are tangent to the market designs in lieu of incentive compatibility of participants.

Incentive-compatible Pricing Mechanism: How do we offer pricing mechanisms that effectively bootstrap information sellers and buyers alike? Both information sellers and buyers—simultaneously—must be provided with strong incentives to use this marketplace. The key here is offering pre-facto set of toolkits for information sellers to choose from (e.g. subscription channel, gradual dutch auction, RFQ, selective disclosure, etc) that maximizes revenue for sellers while lowering unit cost on the buyers’ side.

Credibility of the information: Information are notoriously hard to price without revealing them in the first place. As is with any other existing information exchange, the best that a marketplace can do here is to facilitate signaling of peripheral information between buyers and sellers. The key here is building a credible reputation/identity system that mediates information about the participants in a trustlessly manner.

Aalps' Approach: Four Pillars

A Comprehensive Suite of Tools for Information Sellers — various pricing mechanisms for idiosyncratic information types

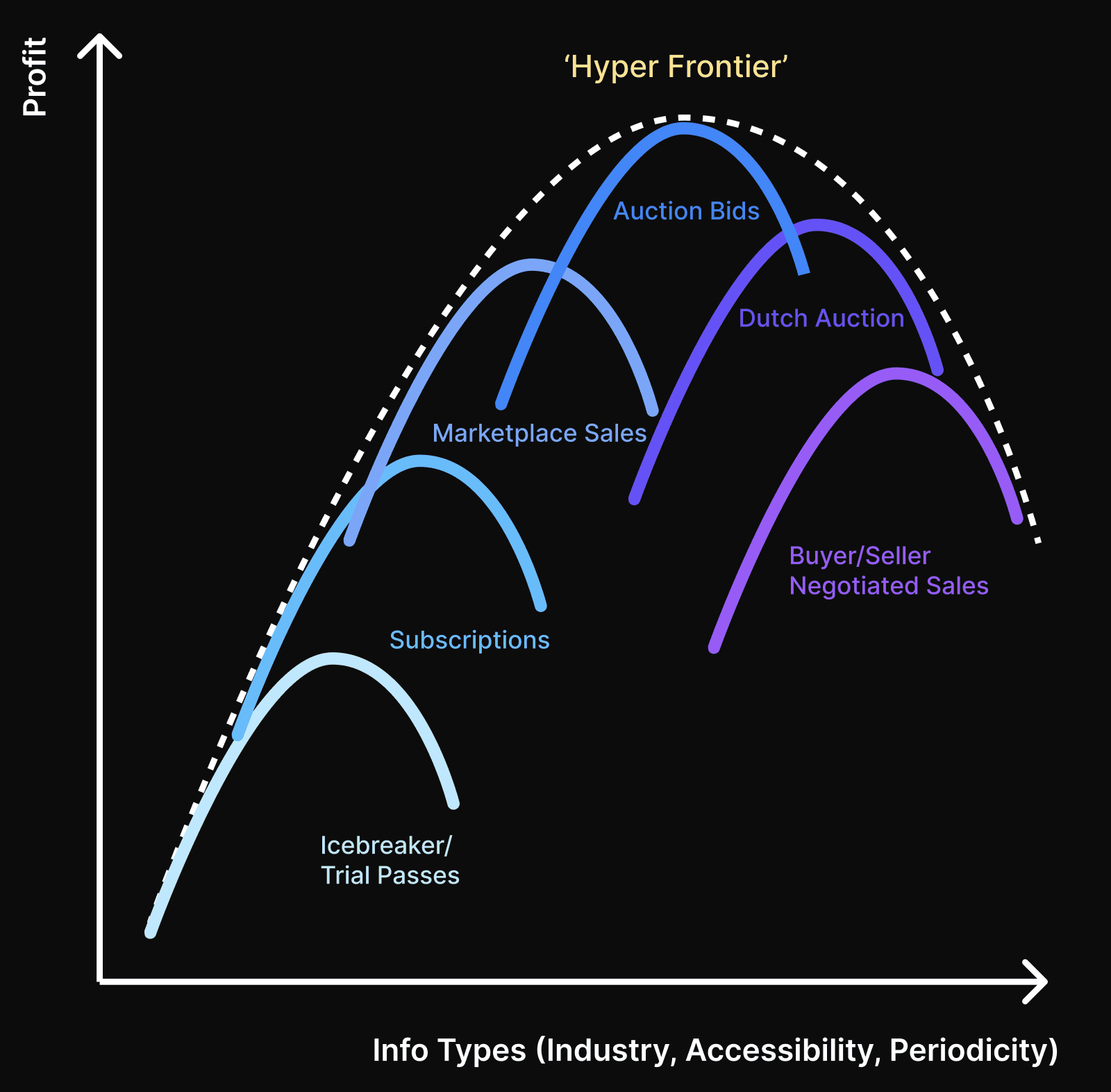

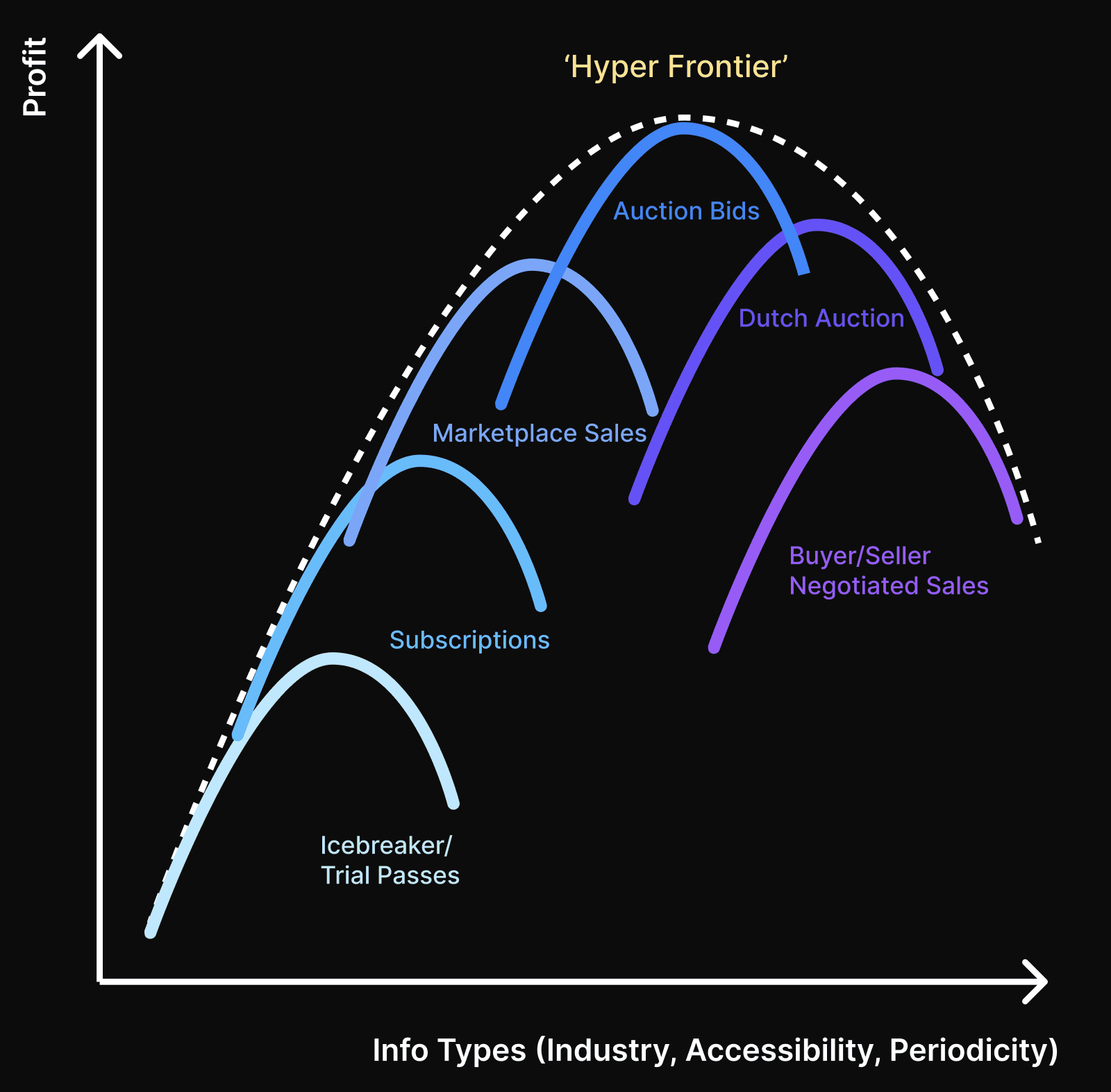

Aalps provides a pre-facto set of different pricing mechanisms that information sellers can choose from before embarking on a trade. If we put on the x-axis the different types of information and on the y-axis the profit generated for information sellers, we can imagine there being an “efficient frontier” of profit realizable for each information type. By providing a union of these pricing mechanisms for sellers to choose from, we are ultimately able to enjoy the hyper-frontier of these efficient frontiers made possible by each pricing mechanism.

Search Engine that maximizes discoverability for information buyers

A successful market should be scalable, especially in this case because commodities are fragmented worldwide. How do we design it so that it can scale globally? The key here is building an effective searching engine for finding potential information sources with precision and low latency (think of what you’d expect of NYC’s Citizen app).

Reputation/Identity System that leverages zkTLS

We leverage zkTLS to accurately measure the credibility of the information. Using zkTLS, we offer multiple way in which information providers can accumulate reputation like through a review system that can be accessed by buyers. Integrations with Reclaim Protocol SDKs, Opacity, and pluto.xyz is already underway. Plus, we maintain on-chain data of past records on information sales that is bulletproof to manipulation. This is among the core reasons why this marketplace must be built on-chain.

ZKP-based VECK scheme for Confidentiality and Anonymity

Confidentiality and anonymity are critical properties that cannot be compromised. We leverage Verifiable Encryption under Committed Key (VECK) to enable anonymous data exchange, and we leverage crypto assets to enable cross-border payments. Via VECK, atomic and fair data exchange is made possible. With recent advances in Zero-Knowledge Proofs and their application, we are now finally able to trustlessly and anonymously exchange information with value. Also, Trusted Execution Environments allows for trustless systems with minimal trust assumptions (generating ZKPs within Eigenlayer AVS TEE environments) for generating proofs.

What It Takes to Achieve Scalability

Iteration of public and private features rollouts will be our focus for the next 6 months — converting unscalable experiments into a scalable and incentive-compatible market designs

We will be leveraging both public and private schemes to understand the underlying objective functions of these various participants and converting these unscalable operations into scalable insights about the market.

We can approach this problem in two different ways: 1) public campaign where we either initiate a campaigns of open bounties (e.g. Major Port Real-Time News Streaming Bounty”) and 2) Private approach where we initially focus on manually matching sellers and buyers on our waitlists so as to test new pricing mechanism and observe the dynamics between the participants from both sides. Iteration of these “confined environment experiments” will result in accumulation of test results and insights that would get us ready to discover the new hyper frontier.

Over the course of these iterations (4 in the next 6 months and 10 more in the following 6 months), the procese will involve ruthlessly zooming in and out within the information “space” and meticulously searching for the explosive “spark” signs of effective seller-buyer matching.

More details on our “Scalable Features” to come in our following posts. Stay Tuned.

What’s Next?

Aalps begins with the commodities market, but it aims for every other market.

Starting with Commodities Market

While Aalps' vision is expansive, the protocol is starting with a specific focus: commodities markets. The commodities sector is uniquely suited for this real-time information approach. (More here: [Aalps Commodities 01] Why Commodities in 2024? ) It's a market where timely news is critical, information asymmetries are common, and the stakes for the global economy are enormous.

Aalps Ecosystem

We leverage the power of prediction markets (Aalps Finance, cash-settled futures exchange) and unique tokenomics to provide an effective incentive system.

First, prediction markets (i.e. cash-settled futures market). In the crypto era, perpetual futures have emerged as a particularly powerful prediction market design. You can read more about perpetuals at [Aalps Research 01] What Is Perpetual Futures? (ELI5 with Intro Resources) However, even the most advanced prediction markets today still primarily rely on public information. The truly valuable insights - real-time, private knowledge held by industry insiders and experts - remain largely untapped. This is the next frontier that Aalps aims to conquer. Efficient markets are rarely hard to achieve, that’s why there are different levels of “efficient” market for the original Efficient Market Hypothesis — check out our previous post about efficient markets: [Aalps Research 05] The Path to “Efficient Markets”.

Second, tokenomics. Information sellers need the right incentives to participate., Aalps' tokenomics and governance are designed to reward info sellers as the key members of the network. The more quality information someone provides, the more they'll benefit from the overall growth of the platform. By aligning incentives in this way, Aalps aims to create a vibrant ecosystem where it pays to share valuable information. As more experts plug in their real-time insights, the network becomes more valuable, attracting more users and further enhancing market efficiency in a powerful flywheel effect.

Commodities are just the beginning. The same mechanisms that can make commodities markets more efficient can be applied to any sector where real-time information is valuable. From equities to energy to insurance, Aalps aims to create efficient information marketplaces for every major industry.

Unlocking the Power of Real-Time Information in Global Markets

The internet revolutionized the free flow of information. Crypto enabled the frictionless transfer of value. Yet despite these transformative technologies, a key piece has been missing: an efficient, scalable marketplace for exchanging information in return for any form of value.

What is Aalps Alpha?

Aalps Alpha is a global information marketplace where participants trade commodities-related information confidentially and anonymously in exchange for on-chain values.

Using crypto as a coordination layer, Aalps constructs a decentralized network where information sellers can directly connect with buyers and monetize their private insights for the first time.

With this global primitive in place, Aalps Protocol reimagines market efficiency at a whole new level. We believe Aalps Alpha will be the critical first step towards redefining the underlying dynamics of the commodities markets in the long term. More on this in our Aalps Manifesto and [WIP v1.2] Aalps Protocol Introduction

What is the problem?

Demand for quality information is extremely high among commodities traders and general industries. But as there is no global marketplace, information is under-supplied. Ones that are supplied circulate only in extremely private circles.

Imagine a Chilean copper mine worker who learns of an ongoing strike, an oil executive who learns of a major new discovery, or a farmer who detects ideal weather conditions for a bumper crop.

These are all invaluable information that could potentially be worth thousands of dollars, if they find the “right” end consumer — whether it be a copper trader in Chicago, oil refinery executive in Korea or a fertilizer manufacturer located in India — along the supply chain. For global professionals, these information are simply invaluable.

Apparently, 90% of them fail to reach to the right person for the time being, because there is no global marketplace where you can buy and sell these information. This led to two consequences. First, while quality information always does exist somewhere, it is not supplied to those in serious need of it. Second, seldom when information is supplied, because there is no marketplace at scale, it circulates only in extremely private circles (e.g. private Whatsapp group chats).

What must be considered when building a solution?

The key to a any successful marketplace is pricing mechanisms that are compatible with various participants’ incentives, scalable matching system, and efficient signaling tools. This also applies to information marketplace for commodities, too.

First, we need to clearly identify what types of information is of interest. We identify three main axis that constitute our mental model map of the information space.

The first axis is along the spectrum of different industries within the commodities industry. This could range from shipping, mining, energy, smelter, refining, manufacturing, packaging, etc.

The second axis is along the spectrum of accessibility of the information. Are these information that can only be attained if you are within a specific organization? Above certain level? Is this something you can still find out as a partnering firm? Is this something anyone physically present in the region also has access to?

The third axis is around periodicity of the information. Is this information valuable if delivered on a periodic manner? (e.g. Indian farm’s crop yield or expected production level of a mining firm) Is this more of an one-off event news? (e.g. an explosion in an Iranian town or a new discovery of a potential mining site) Is this piece of information something that someone would be interested in monitoring and keep an eye on over time?

Moreover, we also add two additional north stars that we constantly return to. These are tangent to the market designs in lieu of incentive compatibility of participants.

Incentive-compatible Pricing Mechanism: How do we offer pricing mechanisms that effectively bootstrap information sellers and buyers alike? Both information sellers and buyers—simultaneously—must be provided with strong incentives to use this marketplace. The key here is offering pre-facto set of toolkits for information sellers to choose from (e.g. subscription channel, gradual dutch auction, RFQ, selective disclosure, etc) that maximizes revenue for sellers while lowering unit cost on the buyers’ side.

Credibility of the information: Information are notoriously hard to price without revealing them in the first place. As is with any other existing information exchange, the best that a marketplace can do here is to facilitate signaling of peripheral information between buyers and sellers. The key here is building a credible reputation/identity system that mediates information about the participants in a trustlessly manner.

Aalps' Approach: Four Pillars

A Comprehensive Suite of Tools for Information Sellers — various pricing mechanisms for idiosyncratic information types

Aalps provides a pre-facto set of different pricing mechanisms that information sellers can choose from before embarking on a trade. If we put on the x-axis the different types of information and on the y-axis the profit generated for information sellers, we can imagine there being an “efficient frontier” of profit realizable for each information type. By providing a union of these pricing mechanisms for sellers to choose from, we are ultimately able to enjoy the hyper-frontier of these efficient frontiers made possible by each pricing mechanism.

Search Engine that maximizes discoverability for information buyers

A successful market should be scalable, especially in this case because commodities are fragmented worldwide. How do we design it so that it can scale globally? The key here is building an effective searching engine for finding potential information sources with precision and low latency (think of what you’d expect of NYC’s Citizen app).

Reputation/Identity System that leverages zkTLS

We leverage zkTLS to accurately measure the credibility of the information. Using zkTLS, we offer multiple way in which information providers can accumulate reputation like through a review system that can be accessed by buyers. Integrations with Reclaim Protocol SDKs, Opacity, and pluto.xyz is already underway. Plus, we maintain on-chain data of past records on information sales that is bulletproof to manipulation. This is among the core reasons why this marketplace must be built on-chain.

ZKP-based VECK scheme for Confidentiality and Anonymity

Confidentiality and anonymity are critical properties that cannot be compromised. We leverage Verifiable Encryption under Committed Key (VECK) to enable anonymous data exchange, and we leverage crypto assets to enable cross-border payments. Via VECK, atomic and fair data exchange is made possible. With recent advances in Zero-Knowledge Proofs and their application, we are now finally able to trustlessly and anonymously exchange information with value. Also, Trusted Execution Environments allows for trustless systems with minimal trust assumptions (generating ZKPs within Eigenlayer AVS TEE environments) for generating proofs.

What It Takes to Achieve Scalability

Iteration of public and private features rollouts will be our focus for the next 6 months — converting unscalable experiments into a scalable and incentive-compatible market designs

We will be leveraging both public and private schemes to understand the underlying objective functions of these various participants and converting these unscalable operations into scalable insights about the market.

We can approach this problem in two different ways: 1) public campaign where we either initiate a campaigns of open bounties (e.g. Major Port Real-Time News Streaming Bounty”) and 2) Private approach where we initially focus on manually matching sellers and buyers on our waitlists so as to test new pricing mechanism and observe the dynamics between the participants from both sides. Iteration of these “confined environment experiments” will result in accumulation of test results and insights that would get us ready to discover the new hyper frontier.

Over the course of these iterations (4 in the next 6 months and 10 more in the following 6 months), the procese will involve ruthlessly zooming in and out within the information “space” and meticulously searching for the explosive “spark” signs of effective seller-buyer matching.

More details on our “Scalable Features” to come in our following posts. Stay Tuned.

What’s Next?

Aalps begins with the commodities market, but it aims for every other market.

Starting with Commodities Market

While Aalps' vision is expansive, the protocol is starting with a specific focus: commodities markets. The commodities sector is uniquely suited for this real-time information approach. (More here: [Aalps Commodities 01] Why Commodities in 2024? ) It's a market where timely news is critical, information asymmetries are common, and the stakes for the global economy are enormous.

Aalps Ecosystem

We leverage the power of prediction markets (Aalps Finance, cash-settled futures exchange) and unique tokenomics to provide an effective incentive system.

First, prediction markets (i.e. cash-settled futures market). In the crypto era, perpetual futures have emerged as a particularly powerful prediction market design. You can read more about perpetuals at [Aalps Research 01] What Is Perpetual Futures? (ELI5 with Intro Resources) However, even the most advanced prediction markets today still primarily rely on public information. The truly valuable insights - real-time, private knowledge held by industry insiders and experts - remain largely untapped. This is the next frontier that Aalps aims to conquer. Efficient markets are rarely hard to achieve, that’s why there are different levels of “efficient” market for the original Efficient Market Hypothesis — check out our previous post about efficient markets: [Aalps Research 05] The Path to “Efficient Markets”.

Second, tokenomics. Information sellers need the right incentives to participate., Aalps' tokenomics and governance are designed to reward info sellers as the key members of the network. The more quality information someone provides, the more they'll benefit from the overall growth of the platform. By aligning incentives in this way, Aalps aims to create a vibrant ecosystem where it pays to share valuable information. As more experts plug in their real-time insights, the network becomes more valuable, attracting more users and further enhancing market efficiency in a powerful flywheel effect.

Commodities are just the beginning. The same mechanisms that can make commodities markets more efficient can be applied to any sector where real-time information is valuable. From equities to energy to insurance, Aalps aims to create efficient information marketplaces for every major industry.